November 2022 Market Update

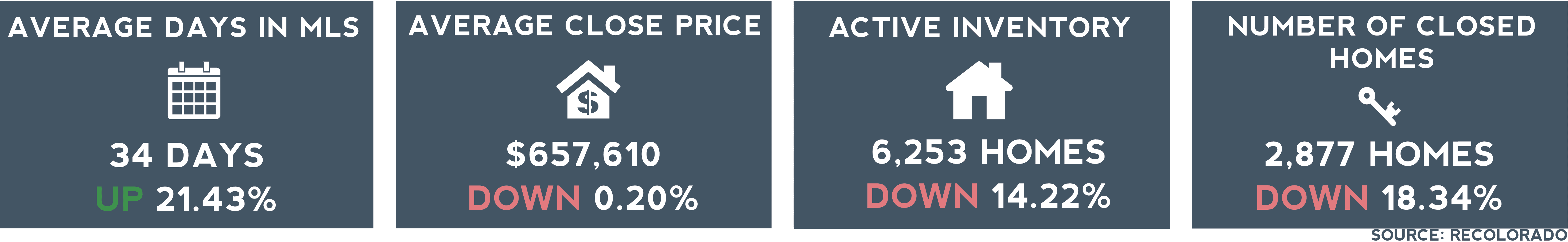

Even as buyers and sellers continue to have confidence in the value of Denver homes, inventory and interest rates have undeniable influences. The economic shifts in 2022 completely upended the pace of the Denver market. Inventory jumped 178.16% from 2,248 to 6,253. Even still, the average close price in November was up 4.66% from last year. Closings in November were down 46.16% from 2021, yet Denver home values persisted.

Inventory

With 6,253 units available at the end of November and 2,877 units closed in the month, there is still limited inventory based on the demand. Inventory actually sits below what it was at this time in 2019. This is all while many Denver buyers have paused their search to wait for what they hope will be lower interest rates. This spring, we will see if interest rates come down or if buyers start to see them as the new norm. When we see this shift, the Denver market will still have limited inventory, preserving home values and driving competition.

Interest Rates

Interest rates settled slightly in November at around 6.5%, but with new Consumer Price Index numbers being released on December 13th, the Fed will again make a decision regarding interest rates. Many economists are predicting a rate increase, but only of 0.50% after the previous 3 rate hikes of 0.75%. For context, the federal interest rate at the beginning of 2022 was around 0.0%, and as of November 2nd, it is 4.0%. While Federal Reserve interest rates are not mortgage rates, their effect on buyer confidence and the cost of borrowing money cannot be overstated.

Updates on the Attached vs. Detached Markets

In 2020 and 2021, we talked extensively about the effects of the pandemic on the attached market. Demand for single-family homes skyrocketed. While seasonality still strongly affects these trends, attached properties have recovered somewhat in demand and pricing. Attached properties in November saw a better list-to-close price ratio at 98.87% vs. the 98.11% ratio of detached. This could be due in part to the demographics of attached home buyers.

Conforming Loan Limits

A critical update regarding financing is the increase in the baseline conforming loan limits from $647,200 in 2022 to $726,200 in 2023. This 12.21% increase will mean more buying power for conforming loan lendees, and fewer buyers will be subject to the more strict requirements of jumbo loans. These requirements include more money down and higher debt-to-income ratios. The baseline loan limit is based on the average price of homes, and after this number stayed precisely the same from 2006-2016 at $417,000, it had a lot of catching up to do in the past 7 years. While most of Colorado will be subject to the $647,200 limit, there are a few counties in the state that are considered “high-cost areas” and have an even higher conforming loan limit. Counties like Denver, Boulder, and Eagle, have an assigned multiplier to adjust for the higher home prices in the areas. For example, the new baseline loan limit for Denver will be $787,750 for a one-unit property.

As we look to 2023, early spring will set the tone for the year. If we see interest rates come down or even just a significant uptick in quality inventory, the trends will start to shift. Denver sellers are confident about the value of their homes. But those who do sell, even at the average 98.32% list-to-sell price ratio, are still realizing incredible gains. Denver home values are up 38% from March 2020 and 151% from 2012. Inventory is naturally an issue when many would-be sellers have lots of equity and low-interest mortgages.