January 2023 Market Update

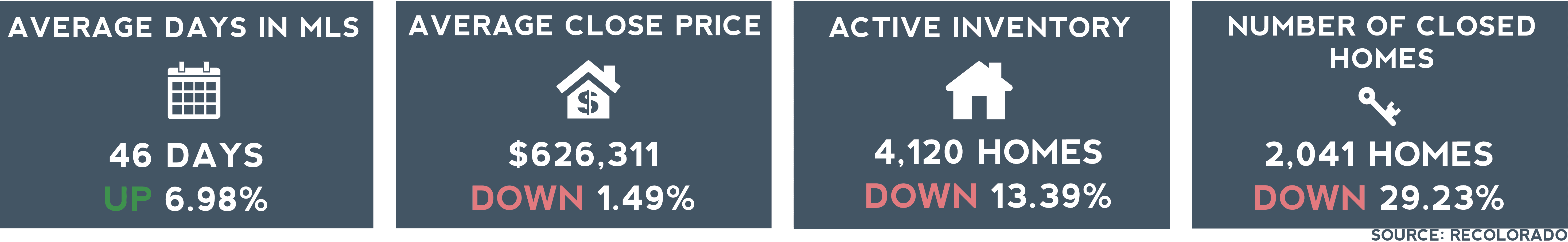

January in Denver, we saw many classic signs of the real estate market reawakening, with new listings up 65.20% and pending listings up 50.61%. Still, those worried about a runaway seller’s market have some hope. Considering year-over-year data, January was a sleepy start to the year. Median days on the market jumped from 5 days in 2022 to 35 days in 2023, median closed prices dipped 2%, and the number of closings was down 30%; all signs pointing to a more balanced market in 2023. Inventory, demand, and interest rates remain the market’s controlling factors.

Inventory and Demand

At month’s end, inventory was down 13.39% from December, leaving Denver buyers with 4,120 listings to choose from. While this dip may seem dramatic, the end of January 2022 left us with only 1,184 listings. A usable metric when looking at inventory data is months of inventory. We find our months of inventory by dividing the number of active listings by the number of homes sold in a month. A balanced market has between 4 to 6 months of inventory. While January 2022 had only 2 weeks of inventory, January 2023 still sits at 7 weeks of inventory.

Interest Rates

After promising messaging from the Federal Reserve, early February finally saw rates dip below 6%, only to later pop back up. Even though average rates now sit around 6.39%, positive economic data has home buyers and home builders optimistic about 2023. As we see Federal Reserve interest rates fluctuate, it is essential to understand that mortgage rates often anticipate these ups and downs. Major shifts and surprises in mortgage rates generally only happen when the market doesn’t expect Fed messaging. For example, when the Fed announced a highly anticipated rate increase in February, mortgage rates dipped to their lowest of 2023. The Mortgage Bankers Association forecasts that the 30-year mortgage will drop consistently this year and average 5.2% in the fourth quarter, tracking with projected reductions to inflation.

Balanced Market?

In just a month, we can’t say if 2023 will be a better year for buyers, but we are off to a promising start. From December, median days on the market are up 13.33%, home prices are down 3.3%, and the close-to-list price ratio is down to 98.15%. While these are significant signs of a more balanced market, with Denver’s high demand and tight inventory, we still foresee many competitive situations for buyers, especially as interest rates have reduced their buying power.

Looking back on January data from mid-February, we can tell significant change is ahead. Many of our agents jumped out of the gate this year, competing in multiple offer scenarios, and some new listings have only been available for 2 days of showings before going under contract. Even still, much of the intense highs of the pandemic-induced low-interest rate buying have subsided, inventory is slowly creeping up, and Denver housing prices remain steady. As always, Generator Advisors are here to guide you through the ups and downs of the Colorado market, so give us a call.