August Market Update 2023

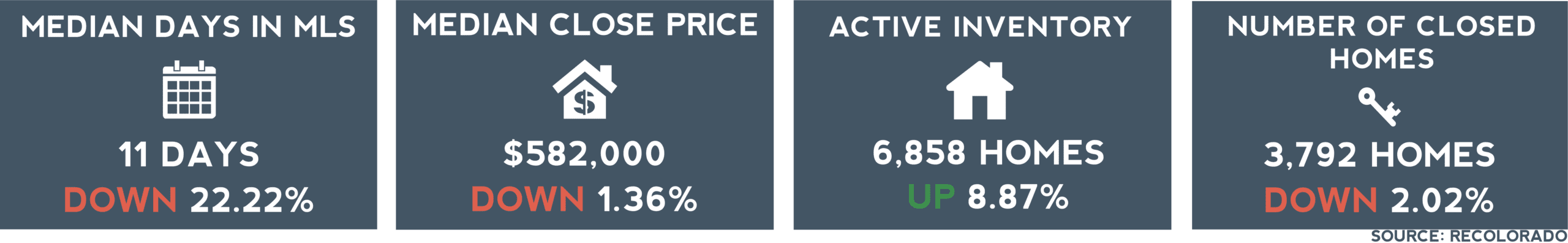

As we delve into the August Metro Denver real estate market stats, rates and inventory are two strong influences. Buyers continue to take time to get comfortable with current mortgage rates, all while there is still a significant inventory crunch. With an 8.87% increase in inventory and a 1.36% decrease in median price, the needle continues to tip in the buyer’s favor. With a close-to-list ratio of 99.46%, more often than not, sellers are negotiating. Despite the current mortgage rates, savvy buyers are finding opportunities to jump into the market while competition isn’t quite as fierce.

Inventory

After the interest rates popped up last summer, many sellers have been patiently waiting for rates to return to 2022 levels. Sellers can only wait so long. This could explain the month-over-month, 1.74% increase in new listings even as days on the market increased 22.22%. A helpful metric when looking at inventory data is months of inventory. We find our months of inventory by dividing the number of active listings by the number of homes sold in a month. A balanced market has between 4 to 6 months of inventory.

Market Segmentation

Months of inventory is a valuable metric to understand the significant market segmentation between price points the Denver market is experiencing. For detached homes priced less than $1,000,000, there are close to 1.5 months of inventory; for detached homes more than $1,000,000, there are 2.5 months of inventory. If you look only at detached homes over $2,000,000, there are 5.79 months of inventory. If you also consider the motivating factors of buyers at those price points, you can better understand the root of this market segmentation. The decision-making factors of the first-time home buyer vs. the buyer looking for an upgrade are vastly different, and often, so are their price points.

Opportunities for Buyers

For years, we’ve kept you updated on the competitive nature of the Denver market for buyers. With more sellers compromising on price and terms, qualified buyers can capitalize. With increased negotiating power, buyers can explore various financing options, down payment assistance programs, and even assumable loans for veterans. However, because of changing rates, buyers must grasp their buying power fully before they embark on their property search.

Larger Economic Factors

While 3,792 homes sold in August, it’s difficult to predict how many would-be buyers and sellers are sitting on the sidelines of the Denver market, waiting for lower rates. Economists are still projecting lower interest rates in 2024. For this to happen, there are broader economic conditions in play. Mortgage rates are most closely tied to job reports and inflation. August brought higher unemployment numbers but also higher consumer spending, an indicator of inflation. Yet still, many economists speculate that the September 20th Federal Reserve meeting will not result in another rate increase. If this is true, it will be one positive indicator of lower rates to come.

Conclusion

In a nutshell, the Denver real estate market continues to be a tale of adaptation and opportunity. The Denver market remains strong even as it inches closer to a market where the sellers don’t hold all the power. The path ahead may be complex, but with the right approach and a knowledgeable agent on your team, you can thrive in the ever-changing Metro Denver real estate landscape.