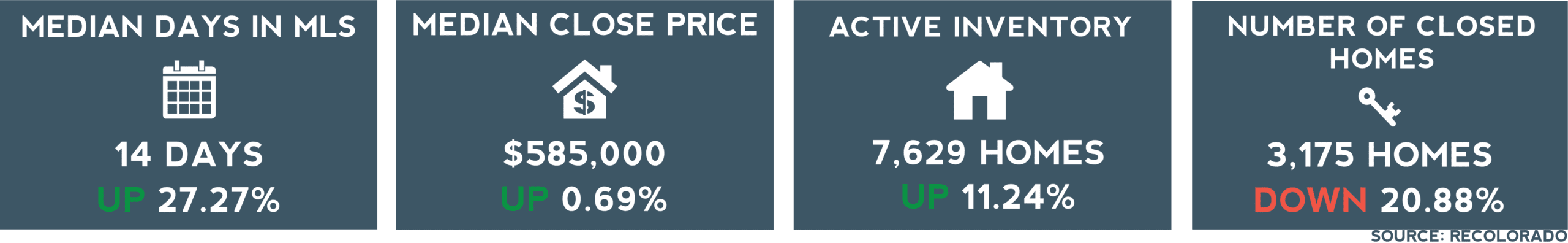

September 2023 Denver Market Update

As the Denver weather cools down, so does the real estate market. Increasing mortgage rates and inventory have created a much different environment than the busy summer season, creating new opportunities. New listings have dropped 5.92% from August, but we finished the month with 11.24% more active listings due to timid buyers. Understandably, pending sales are down 9.29%, and closed sales are down 20.88% from August. However, home values are persisting. The average close price is down 0.68% from 2022 and is still up 40.09% from 2019.

Mortgage Rates

Faced with 3 consecutive weeks of mortgage rate increases, it is not surprising that buyers are being especially discerning. Since the Fed started increasing its short-term benchmark rate from 0% in March of 2022, the rate has incrementally risen to 5.25% in an effort to combat inflation. This policy has indirectly pushed mortgage rates up, with average mortgage rates hitting a 23-year high at the beginning of October. Average mortgage rates dipped below 8% on October 12th, but are projected to stay above 7% until spring 2024. This puts both buyers and sellers in difficult situations. Buyers have become incredibly discerning as home values persist as they more often request rate buydowns and other seller concessions. Sellers are now faced with a smaller qualified buyer pool in addition to expected seasonal shifts.

Inventory Shifts

We talk a lot about months of inventory as an indicator of whether it is a buyer’s or seller’s market. The figure takes the closed sales and compares them to the available inventory. If no new units came on the market and closed sales remained consistent, there would be 2.4 months of inventory in the Denver metro market. This is up 47.24% from last month. While we usually consider a buyer’s market as 4 months of inventory, this figure indicates that the market is becoming more balanced. Active inventory is still 0.70% less than last year at this time and 17.84% less than September of 2019. There are still plenty of buyers in the Denver market, but they are becoming more empowered to ask for seller concessions and move-in ready homes.

Preparing for the New Year

With mortgage rates and home values staying steady, how should homebuyers and sellers prepare for entering the market? Our advice to sellers is to check off that “honey-do” list. We are seeing more inspection objections, so any minor fixes and upgrades that you can make will set you up for a smoother listing process. Presenting your home as polished as possible will appeal to buyers who may be spending all their cash just to get into a home. For buyers, now is a great time to explore the types of homes that are available in Denver. Are you team Denver Square, or is new construction a must for you? With limited inventory, being educated and prepared to move quickly will put you in the best position to get the right home under contract.

Based on the data, the Denver market is resilient and robust despite high mortgage rates and limited inventory. Now is a great time to get in the market if you plan to invest long-term. Competition is lower, and you are likelier to have a seller work with you for the best terms. If rates fall in the future, you can take advantage. Markets are constantly changing, and those identifying the opportunities at this time will be the long-term winners.