September 2022 Market Update

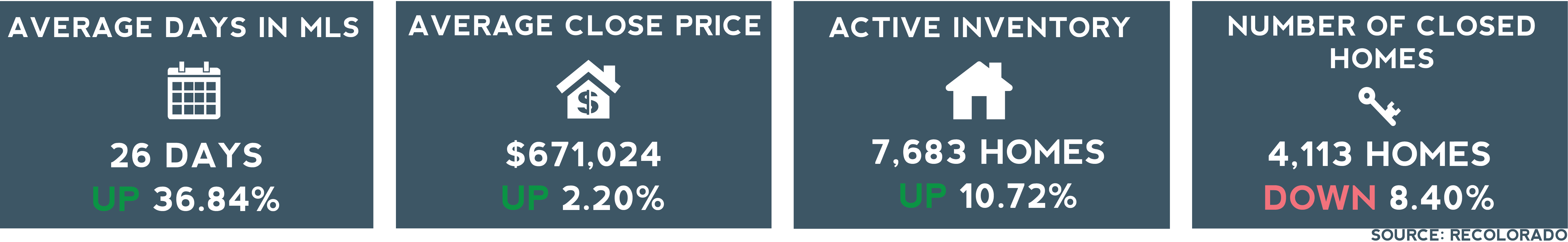

The Denver market is a classic example of supply and demand. After years of unsustainable demand, interest rates have made many buyers take pause. The pause means there are 7,683 active listings in Denver with an average of 26 days in the MLS. We are seeing indicators of a more balanced market and yet the median home price is still up 0.87% for the month and 9.43% year over year. It is common for the Denver market to slow down in September, but it is undeniable that national economic factors are also at play.

The Denver market is quite insulated from the economic ups and downs felt across the country, but as interest rates hover around 7%, even the robust Denver buyer pool is thinking about renting. Buyers that are still in the market have seen the close-to-list price ratio drop from 101.88% to 98.91%, an indicator that buyers are pulling some of the power back from sellers. The appraisal waivers and inspection objection waivers that were commonplace in the spring are now rare.

For sellers, pricing your home correctly is critical. Overpriced homes are positioned for price reductions. Move-in ready homes in prime neighborhoods are still getting multiple offers when priced appropriately. If you are a homeowner that is looking to sell even in the next few years, now is a great time to handle deferred maintenance and cosmetic updates so when rates eventually do come back down you are ready to list.

The federal reserve is trying to curb inflation by curbing spending. Part of that is increasing interest rates. So as lenders adjust their pre-qualifications, buying power is changing. The lower rates of ARMs and Jumbos are becoming more attractive options. ARMs now have many more lendee protections than the similar options available prior to 2008, and can be a great option for buyers who are anticipating refinancing at a lower rate within the next few years. Jumbos can be a great option for confident buyers who want to take advantage of increased inventory. Many economists are predicting interest rates will be back under 6% as soon as the spring and lenders are expecting a renewed wave of refinances if this does happen.

Interest rates for buyers and inventory for sellers plus seasonality across the whole market are changing the Denver market. The safest investment is usually a long-term one and we still believe it is a good time for buyers who plan to stay in a home for 3 years or more to make a purchase. There are ways to leverage current conditions to work in your favor whether you are a buyer or a seller. Talk to your Generator advisor about what that could mean for you.