November Metro Denver Market Review

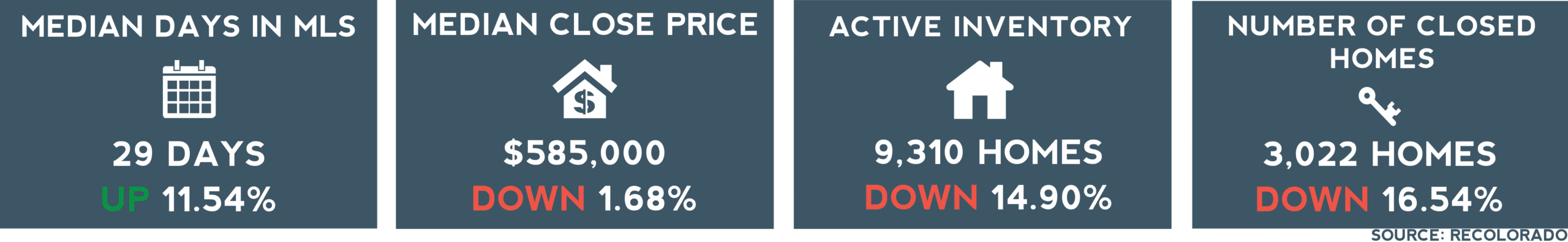

In November, the Denver Metro real estate market saw familiar seasonal patterns with a few noteworthy twists as inventory declined. With interest rates hovering around 7%, buyers saw more inventory, seller concessions, and price reductions. The median days on market in the MLS rose to 29 — a 31.82% increase from last November — giving buyers additional leverage in negotiations. On the other hand, sellers are still finding paths to success with the right strategy. Buyer activity remained steady, and home prices were up from last November, with 21.95% more homes pending and the median closed price rising 3.05%. Here’s a closer look at the trends shaping the market as we head into 2025.

Seasonal Slowdown with a Twist

November followed the typical seasonal trend of slowing market activity, but some notable differences emerged. Active listings dropped 14.9% month-over-month, and new listings fell 41.47%, reducing the flow of fresh inventory as buyers and sellers prepared for the holiday season. Pending sales were down 10.54%, and closed sales fell 16.54% from October. However, the year-over-year perspective reveals a more active November than last year. Active listings were up 39.29%, pending sales increased 21.95%, and closed sales rose 6.04% from November 2023. While activity still slowed with the seasonal shift, November’s performance was a reminder that buyers and sellers are still engaging in the market.

Inventory and Buyer Opportunities

Inventory declines are typical for November, but the year-over-year increase in available homes gave buyers more choices than they had this time last year. Active listings in November 2024 were up 39.29% from November 2023, creating options and opportunities for negotiations for buyers. Homes with higher days on market created opportunities for buyers as well. Homes that stayed on the market longer often prompted sellers to offer concessions or price reductions. In November, roughly 50% of homes that went under contract had at least one price reduction, and about 60% of sellers provided concessions, often in the form of rate buydowns or repair credits—for buyers seeking the right deal, homes with more days on the market presented clear opportunities.

Seller Strategy for Success

Despite increased days on market and seasonal slowdowns, sellers still had opportunities to secure strong offers. The close-price-to-list-price ratio was 98.51%, down only slightly from October (98.66%), reflecting steady buyer demand. Sellers who priced their homes competitively and prepared them well, found success, as shown by the 3.05% year-over-year increase in the median closed price. The median days in the MLS climbed to 29, up 11.54% from October and 31.82% from last November. Sellers entering the market this winter should prepare for longer marketing times, but can still position themselves to achieve strong offers by focusing on pricing, presentation, and negotiation flexibility.

What’s Driving Interest Rates? It’s More Than Just the Fed

Unsurprisingly, borrowing costs continue to be one of the biggest factors shaping buyer behavior. While the Federal Reserve’s stance on interest rates is often the focus, it’s not the only factor influencing mortgage rates. Bond market movements, the monthly Jobs Report, and consumer confidence all are pieces of the puzzle. November’s rate volatility was a prime example of this. As inflation data, consumer sentiment, and political uncertainty unfolded, rates fluctuated. However, as some stability returned, so did buyer interest. Mortgage application data showed a 16% increase in applications as buyers responded to the relative stability of 7% mortgage rates after weeks of higher levels.

Looking ahead to 2025, forecasts from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) suggest rates will remain in the 6.1% to 6.4% range. While these rates are higher than in recent years, stability may be the key to bringing more buyers back into the market. Buyers and sellers should consider this potential for more competition in 2025.

Year-End Perspective and Market Insights

While this November was more active than 2023, the pace of the market has shifted since 2022. Year-to-date, the number of closed homes is down just 0.31%, and sales volume is up 2.65% compared to 2023. However, compared to 2022, the number of closed homes is down 18.66%, and sales volume has dropped 16.50%. This year’s trends indicate a more balanced market. For sellers, pricing strategy and preparation remain critical, while buyers should continue to watch for well-priced homes with longer days on market for potential deals. Looking ahead to 2025, if rates stabilize as projected, buyers may face more competition as pent-up demand returns in the spring. Whether buying or selling, preparing for a more active early 2025 market could be key to achieving success.