November Metro Denver Market Review

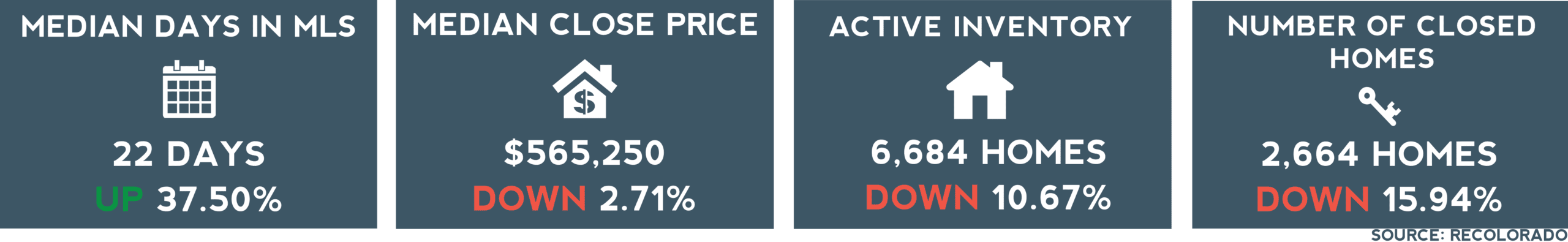

In November, the Denver Metro Area’s real estate market showcased significant seasonal shifts and unique opportunities for both buyers and sellers. When examining November’s data, contrasting narratives emerge. Comparing November 2023 to November 2022 reveals marginal differences: active listings increased by 6.89%, new listings rose by 1.04%, yet closed sales dropped by 13.98%. However, a comparison of November 2023 to October 2023 presents a different picture: active listings decreased by 10.67%, new listings plummeted by 28.93%, and closed sales fell by 15.94%. This contrast indicates how, when seasonal and market shifts are moving in the same direction, they can tell an exaggerated story of the market outlook while, in the broader context, these adjustments remain relatively modest and easily credited to interest rate changes.

Buyer’s Options

Even with higher interest rates, buyers are the ones running the market. With more inventory than in recent memory, buyers have more options. Inventory is 6.89% higher than in November of 2022 at 6,684 homes. Buyers not only have more inventory, but also less competition. Many buyers are waiting for lower interest rates before jumping into the market. Those in the market now, can lock in homes at a lower price and refinance if predictions of lower interest rates come to fruition.

Seller’s Outlook

With median days on the market up to 22 days, sellers can expect to spend more time listed. Additionally, especially if sellers price their homes ambitiously, they can expect to take a price reduction or offer financing concessions to get their homes under contract. Buyers have higher standards for homes when there is little competition and high-interest rates. They are coming to expect more from sellers, including seller-financed rate buydowns, beefy inspection objections, or just a lower price. Concessions aren’t easy to track in our data, so they might explain why the close-to-list price ratio remains so strong at 98.56%.

Market Trends and Challenges

Towards the month’s end, interest rates declined to 6.5%, which caused a small flurry of activity. If this trend continues into spring, we anticipate a busy season with more buyers and sellers entering the market. Yet, concerns remain about inventory levels, given that many homeowners have rates below 3% or own their homes outright. This scenario, combined with high borrowing costs and elevated home prices, presents an ongoing challenge in the Denver market’s inventory. Despite buyer frustration, this situation continues to push prices higher and safeguards home values.

In summary, while the market presents opportunities such as expanded inventory and negotiation advantages for buyers, challenges persist in limited new listings and slow housing sales. Sellers, however, benefit from continuing buyer demand due to limited inventory, even with higher purchasing costs. The shifting landscape indicates a potential return to stability amidst fluctuations in various market aspects.