March 2025 Denver Metro Market Review

March in the Denver Metro market brought more inventory and price stability, indicators of a more balanced market. A deeper dive reveals a tale of two markets: homes priced near the median, in good condition, and located in desirable neighborhoods are still selling quickly. Meanwhile, listings with delayed maintenance, high prices, or those that just didn’t check enough boxes for buyers, spent more time on the market and often required more flexibility from sellers. For buyers, choices are expanding. For sellers, strategy matters more than ever.

Inventory and New Listings Continue to Rise

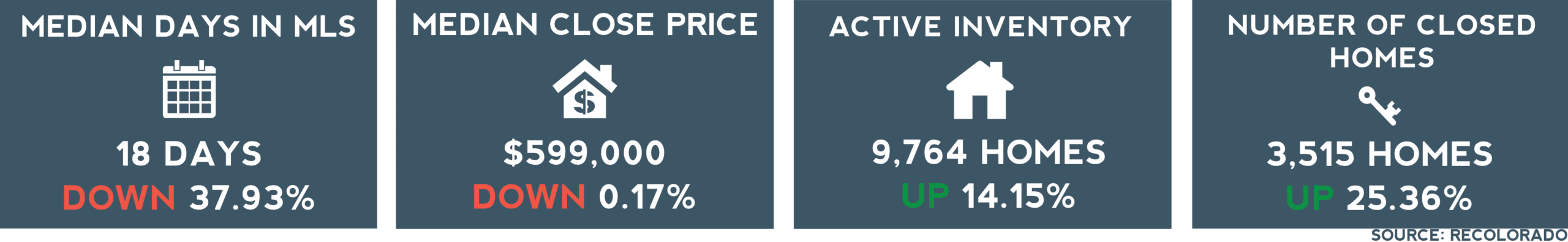

One of the most notable trends in March was the continued growth in inventory. Residential inventory rose 14.15% from February and an impressive 66.93% year-over-year—signaling a more balanced market than in recent years. New listings were also up significantly, increasing 32.47% from February and 29.06% from March 2024. Attached homes are leading that surge, with new listings up 87.24% year-over-year. Detached listings rose a solid 29.25% compared to last March. However, buyer activity hasn’t matched that growth. Closings were down 5.13% year-over-year, and by the end of the month, there were 9,764 active listings—up 66.93% from the same time last year.

For buyers, this means more options and less competition than during the pandemic boom. For sellers, thoughtfully preparing their homes, with competitive pricing and smart marketing, is more important than ever.

Prices Remain Stable Despite Shifting Dynamics

Home prices held steady despite the rise in inventory and average days on the market. The median sale price in March was $599,000, down only 0.17% from February and still 0.67% higher than 2024. In light of the other economic shifts in play, including increased supply and affordability challenges, it is an indicator of the tenacity of the Denver market. For buyers, price stability offers some predictability after the rapid price jumps of the recent past. For sellers, it reinforces the need for accurate pricing and realistic expectations, overpricing is more likely to result in extended days on the market.

Buyers and Sellers

With 66.93% more active listings than last March, buyers have more negotiating power and breathing room. The median days on the market rose 63.64% year-over-year, now at 18 days, giving buyers more time to make thoughtful decisions. This market is especially favoring traditional layouts with modern amenities and is rewarding sellers who have lovingly maintained and improved their homes. The close-to-list price ratio in March was 98.98%, down slightly from last year and well below the 104%+ averages seen at the market peak. This means buyers are negotiating again, and sellers who want to compete need to do more than just list; they’ll need to present a compelling value.

Mortgage Rates Hold Steady While the Market Shifts

This spring, one of the more surprising dynamics is how little mortgage rates have moved, even amid broader economic volatility. Average 30-year fixed rates dipped slightly in early April to around 6.6%, lower than earlier in the year but still far from the 3% range seen in 2020–2021. Despite the 10-year Treasury hitting a six-month low, this limited rate movement suggests rates are likely to persist at this level – a sentiment many economists echo. While some buyers had hoped for a meaningful drop this spring, many are now adjusting expectations and moving forward with today’s rates in mind.

Market Segments to Watch

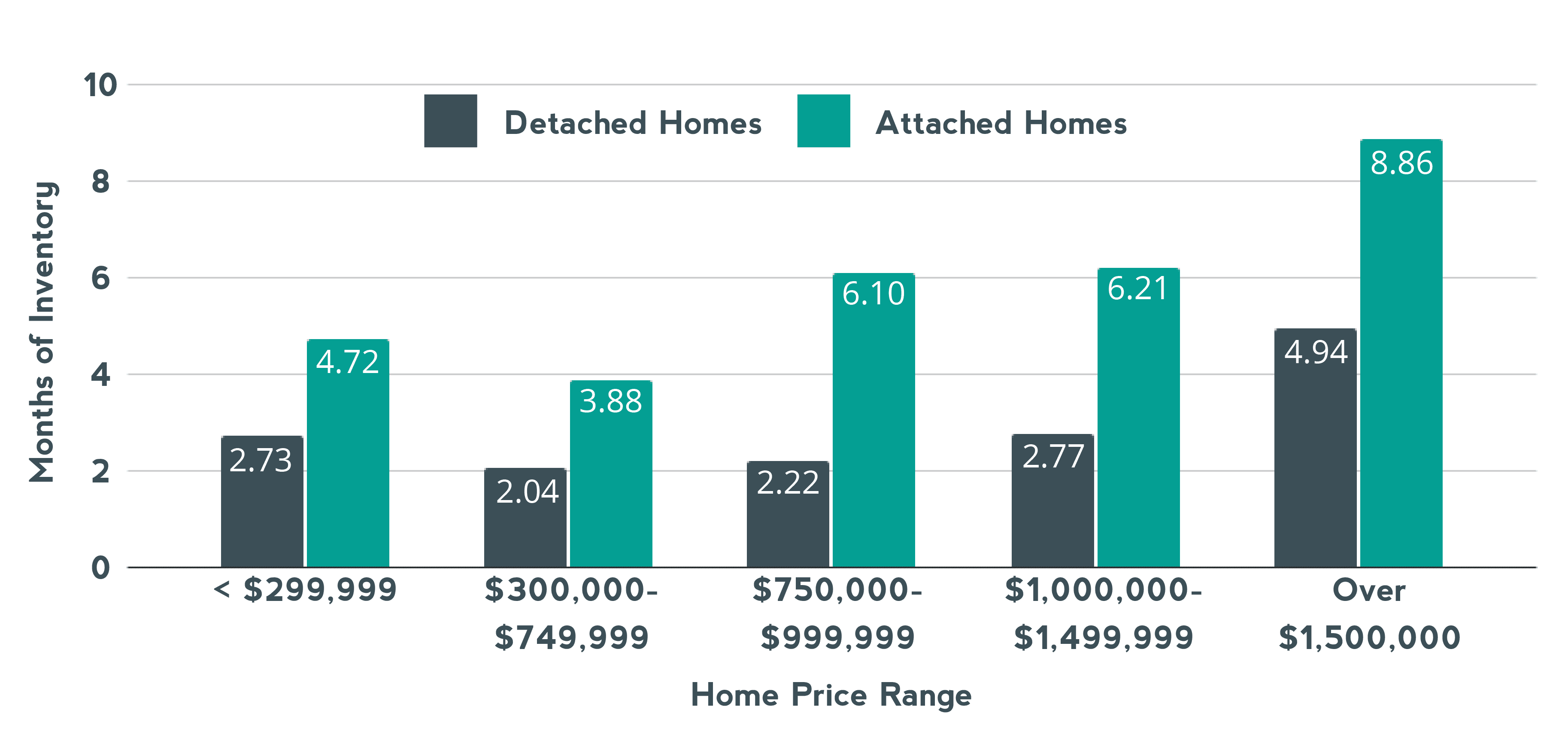

The Denver Metro market is dynamic, and different segments are seeing totally different trends. One way we calculate a segment’s performance is by its Months of Inventory, or MOI. MOI is calculated by dividing the number of active listings by the number of closed sales in a given month. Generally, under 3 months of inventory signals a seller’s market, while over 6 months indicates a buyer’s market.

In March, the most competitive segment was detached homes priced between $300,000 and $749,000, with just 2.04 months of inventory and 1,682 closings, a strong seller’s market. In contrast, attached homes over $1.5 million had 8.86 months of inventory, giving buyers more negotiating power and more time to decide.

Final Thoughts

March 2025 has continued the balancing of the Denver Metro market with stable prices, rising inventory, and a slower buyer pace. Sellers may experience more time on the market, but those who price strategically and prepare their homes well can still find success. For buyers, more options are available, offering more time to find the right fit. As the market stabilizes, both buyers and sellers have opportunities to capitalize.