August 2022 Market Update

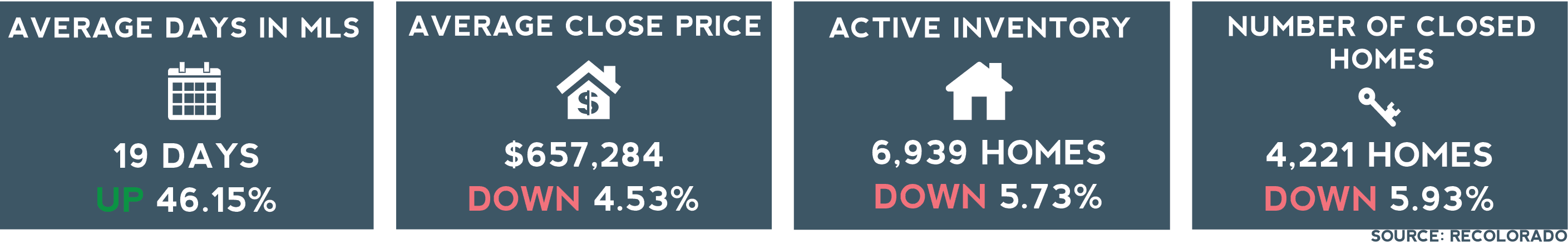

In what felt like a blink of an eye, we find ourselves on the fall side of summer. As with many Augusts, we saw a seasonal shift in the Denver Metro market in addition to rising interest rates. Inventory is steady, average sales prices are slightly down and days on the market are up. We saw both buyers and sellers starting to transition into wait-and-see mode. Both are waiting for consistency in the economic forecast.

Buyers who remained active in the market in August enjoyed the lessened competition and lower average closed price, while many sellers found themselves having to reconsider their asking prices. Closed prices in August were an average of 99.41% of the list price, this metric takes into account that there are certainly still listings getting multiple over-asking offers, but there are also sellers who are having to adjust their expectations. In August, the median sale price was down 2.54% to $579,900, but this is still up 8.49% from last year.

There were just under 7,000 active listings in Denver at the end of August, giving buyers almost over twice the options as this spring, but for context, new listings in August were down 15.5% from last year and the average number of active listings for August in Denver is 15,900. We saw a record high in 2006 at 31,664. So when looking at the current inventory in a historic context, there just isn’t enough inventory to make us concerned with the health of the Denver market. Even those who bought in spring 2022 with their eyes on the future, should find that owning property in a low inventory market like Denver is a great asset.

As interest rates reached 5.99% this August and with economists predicting a third consecutive rate hike of .75%, it’s hard to overlook the impact rates have on the market. It is more expensive to buy a home today than it was this spring. Homeowners are hesitant to give up their favorable interest rates even if they were hoping to move this fall. This limits the buyer pool and leaves mostly first-time home buyers and those moving to Denver.

A cyclical market can only be called that if there are ups and downs. After we saw average home prices fly above $700,000 this spring, we expected a balancing. The market reflects a consumer concern for national and global economic environments as well as the seasonal slowdown of late summer. Meanwhile, there is a climate right now that can benefit buyers. Denver rent is up 20% from 2019. In a national report by Redfin, they estimated that people moving to Denver have 12% higher budgets than those currently living here. Buyers that are not willing to waive their contingencies and don’t want to pay over the asking price, may have an opportunity now to enjoy more leverage in transactions. As always, the market is changing. Contact your Generator advisor for a current market analysis, customized to your needs.