March 2023 Market Update

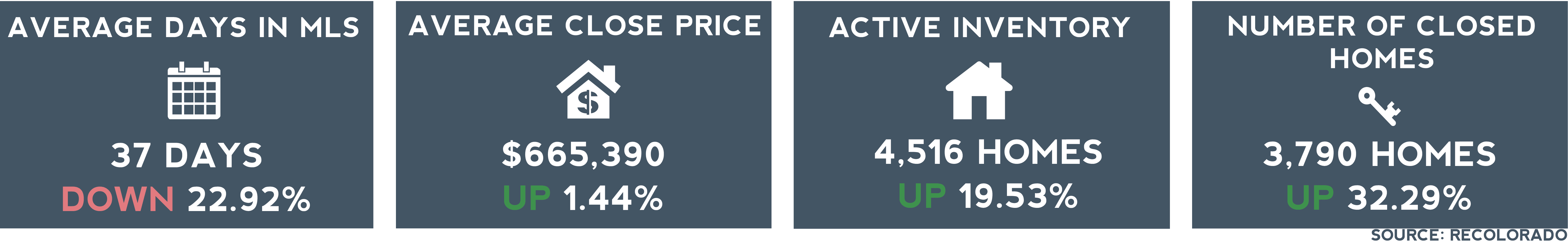

The end of March marks the beginning of spring for the Denver Metro market, so where do we stand? At month’s end, listings were up 19.53%, and closed homes were up 32.29% month over month. This increased activity has brought the average closed price up 1.44% to $665,390 and the days on market down 22.92% to 37. While these numbers a year ago would feel like a dramatic shift, this is all under the influence of a 2% jump in interest rates.

Inventory and Seasonality

With spring in the air, seasonality is a major market influence. Many buyers who were scared off by high-interest rates last summer are returning to the market at similar rates, but increased inventory. March inventory is up 103.33% from last year, but still sits at only 4,516 units. 3,790 homes closed in March, meaning that even with twice as many available homes as last year, the market has less than 2 months of inventory. Experts suggest a balanced market has 4 to 6 months of inventory.

Buyers have to be strategic and make competitive offers on hot homes. With Goldman Sachs reporting that 99% of homeowners have interest rates below 6%, many are hesitant to make a move. Real estate, however, is influenced by real life, so even the 72% of homeowners with rates below 4%, aren’t immune to the factors that cause an owner to sell. Real-life events like job changes and growing families will keep inventory coming, though it may be limited.

Days on Market

When it comes to new listings, the story goes one of two ways, either the home is snapped up immediately, or it sits for a few weeks. We see homes in the former category incite bidding wars that often include offers with limited response time. In these cases, we see homes go under contract before the weekend ends. These homes pushed the close-to-list price ratio up to 99.8%. On the other hand, there is a portion of the available inventory that is not priced appropriately initially or has some other polarizing attribute, such as proximity to major roads or limited amenities. We are seeing these homes make price reductions and spend 2.25 times longer on the market. Buyers are paying more for the same thing as their 2022 counterparts and are understandably picky.

Market Influences

After the ups and downs of the market in March, somewhat surprisingly, the Fed decided to only increase rates a quarter point. Strong employment numbers and increases in consumer spending kept the market positive even as six banks failed. This puts mortgage rates in an interesting position. Time will tell if the Fed’s outlook remains positive or if the predictions of a true recession come true. We still believe that in a competitive market like Denver, buyers, and sellers are partially insulated from these ups and downs. Inventory remains low and competition for turn-key homes is fierce, indicating there is a strong, qualified buyer pool. As long as this persists, home values will stay consistent.

The mortgage rates of March 2022 feel a lifetime away, with rates 2% higher today, and the toll that takes on a buyer’s power is undisputed. However, Denver’s highly competitive market has kept home prices stable. There are opportunities for buyers, especially those willing to put some love and elbow grease into a property. The market is constantly adjusting, so make sure your broker is keeping up.