October 2022 Market Update

The current marketplace is giving buyers what was basically unheard of in the last couple of years; time. This fall, we are feeling the seasonality of the Denver market like we haven’t since 2019. By considering both the month-to-month, and the year-over-year numbers, we can see that the Denver market is finding a comfortable balance that is a long time coming.

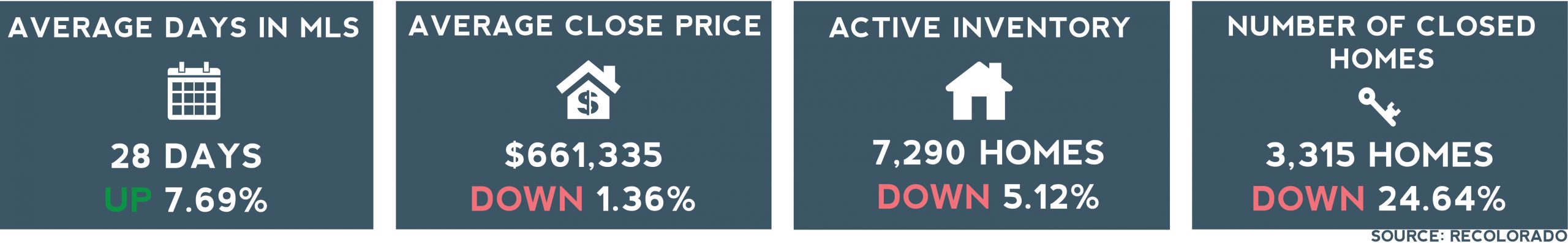

The average days on the market in October was 28, twice that of October 2021. Inventory declined 5.12% from September, but is up 115.94% from last year. Even still, inventory sits 17.38% below what it was in October 2019. The average close price is down 1.36% month-to-month but up 8.33% year over year. Close to list price dipped to 98.72%, down from 101.65% last year.

Outside of seasonality, interest rates are the most significant influence on the market. With interest rates consistently over 7%, buyers who were unable to find homes last year are seeing rates that are 3.125% higher. It’s no surprise that mortgage applications, a measure of buyer demand, are down. We anticipate that buyer demand will eventually increase either as rates dip slightly or buyers get used to these rates.

If you are one of the 71% of Colorado homeowners who have financed your home, you might also be one of the 92% with a rate below 5%. With so much of the market’s supply locked into rates well below the current lender offerings, we expect to continue to experience a supply issue in Denver. When demand outpaces supply, we expect Denver home prices to continue to climb.

In a changing market like Denver, it’s crucial to put metrics into perspective. Markets ebb and flow regularly in the short term, and most real estate investments are long-term. The Denver market continues to be a solid long-term investment. Talk to your Generator advisor for the most up-to-date information on market changes.