2022 Market Update

The Denver real estate market in 2022 told two contrasting stories; the late winter and spring had continued the frenetic and competitive pace of the last two years in response to historically low-interest rates. Buyers often waived all or some of their contingencies and paid well above the asking price to be competitive in multiple offer situations. As interest rates started to climb in the late summer and fall, there was a noticeable balancing of the scales. Days on the market increased, and home prices stopped climbing. More homes were on the market, giving buyers precious commodities, time, and bargaining power. As the page turns to 2023, inventory and mortgage rates continue to drive Denver market trends.

Inventory and Buyer Demand

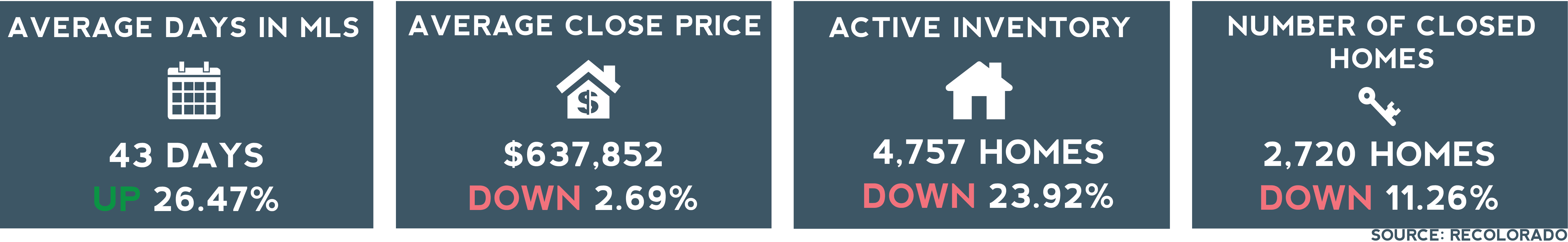

While inventory in December dropped 23.92%, the 4,757 available units were 222% more than at the end of December 2021. Buyers and sellers feel a change coming, and many are waiting for it. Sellers want to sell at the price they saw their neighbor sell in the spring of 2022, and buyers are wishing for the buying power that lower interest rates provide. With 24% of mortgages locked in below a 3% interest rate and 38% of homeowners not carrying a mortgage, homeowners need a solid incentive to list. A drop in new construction will stress an already limited Denver inventory. Regarding buyers, the largest borrower age group is 32, and the average age for first-time homebuyers is 34. If interest rates change, we expect pent-up demand to strain already limited inventory in 2023.

Interest Rates

With the news of a .1% dip in core CPI in January, the markets responded with the lowest mortgage rates in 4 months. If inflation recovers and unemployment increases, we expect mortgage rates to decrease. Some buyers are jumping on the available inventory with a plan to refinance later. Many sellers are still offering rate buydowns and concessions, and buyers with confidence in the Denver market are making purchases.

Home prices

Denver homes appreciated 44.6% between January 2020 and May 2022. Since then, home prices have dropped 4.95%. It is hard to overstate how unusual appreciation of this kind is, so a correction is to be expected. It is common to see home prices dip in December. Pricing homes correctly is more crucial than ever. In December, homes that made a price reduction were listed for twice the days as homes that were priced appropriately from the start. Sellers must consider the current market conditions rather than dwelling on the prices and the buyer demand they saw in the spring of 2022.

What are the signs of a shift? Once rates drop below 6%, we expect a significant increase in buyers in the market and sellers to cater to them. Spring and summer seasonality could amplify the effect. Early spring will set the tone for the year. After a year of highs and lows, Denver home values are still up 1.58% from December 2021 and 151% from 2012. Inventory is naturally an issue when many would-be sellers have significant equity and low-interest mortgages. Even still, many would-be buyers and sellers are waiting for “the right time” and are sitting on the sidelines. Once the market starts to change, we expect them to jump back in. If that is you, give us a call for a market analysis catered to your needs.